Germany’s energy policy is a complex story of bold commitments, shifting priorities, and unavoidable geopolitical realities. As the country transitions to renewable energy through its Energiewende (energy transition) policy, it faces challenges balancing climate goals, energy security, and economic demands. This article explores Germany’s phase-out plans for coal and nuclear energy, the geopolitical pressures that have reshaped its decisions, and the evolving energy consumption trends as depicted in the 2023 energy consumption chart. It also highlights Germany’s reliance on energy imports from its nuclear-reliant neighbors, creating a paradox that reflects the intricacies of global energy interdependence.

The Nuclear Energy Conundrum

Phase-Out Announcement (2000):

In 2000, Germany initiated plans to phase out nuclear energy entirely by 2022. This decision aligned with public sentiment at the time, which was largely anti-nuclear due to environmental and safety concerns. Nuclear power, while efficient and low-carbon, was seen as incompatible with Germany’s long-term goal of achieving sustainability through renewable energy.

Reconsideration After Fukushima (2011):

The 2011 Fukushima nuclear disaster in Japan was a turning point. Then-Chancellor Angela Merkel accelerated the nuclear phase-out as public fears escalated. Within weeks, Germany closed eight reactors, with plans to shut down the remaining ones by 2022. This decision was praised as a decisive step toward green energy but was criticized for increasing Germany’s reliance on fossil fuels and energy imports.

Energy Crisis and Deadline Extension (2022–2023):

In 2022, the Russian invasion of Ukraine triggered an energy crisis across Europe. Germany faced shortages due to its overreliance on Russian gas imports, forcing a temporary reversal of its nuclear phase-out. Three remaining reactors were kept operational until April 2023 to ensure grid stability during winter, showcasing Germany’s need to prioritize energy security in emergencies.

Coal Phase-Out and Its Complexities

Initial Phase-Out Commitment (2019):

In 2019, Germany committed to phasing out coal power by 2038, with the possibility of accelerating the timeline to 2030 in some regions. This was a significant step for a country that historically relied heavily on lignite (brown coal) and hard coal for energy production.

Pressure to Accelerate the Timeline:

By 2022, the government revised its goals to phase out coal in western regions by 2030. However, the continued operation of lignite mines, particularly in eastern Germany, reflects the economic and political challenges of achieving this target.

Coal Use Amid the Energy Crisis:

The Ukraine conflict forced Germany to reactivate mothballed coal plants in late 2022 to compensate for reduced gas supplies. This temporary measure, while necessary, raised concerns about Germany’s commitment to climate targets. The paradox of reintroducing coal highlights the struggle between environmental ambitions and real-world energy demands.

Geopolitical Influences on Germany’s Energy Policy

Germany’s energy decisions have been profoundly shaped by geopolitical events, most notably its relationship with Russia and its need for diversification of supply sources.

Russia’s Role in the Energy Crisis

- Gas Dependency: Before 2022, Germany imported 55% of its natural gas from Russia, facilitated through pipelines like Nord Stream 1 and the now-defunct Nord Stream 2.

- Sabotage and Supply Cuts: The sabotage of Nord Stream pipelines in September 2022 marked a turning point, forcing Germany to pivot away from Russian gas imports and accelerate diversification efforts.

Global Energy Partnerships

In response to the crisis, Germany has forged new energy partnerships:

- Liquefied Natural Gas (LNG): Germany expanded LNG imports from the U.S., Qatar, and other nations. New LNG terminals on Germany’s northern coast were built to enhance energy security.

- Hydrogen Collaborations: Germany is investing heavily in green hydrogen projects in cooperation with countries like Norway, Australia, and North African nations. This emerging technology is expected to play a key role in Germany’s long-term energy strategy.

European Energy Cooperation

Germany’s energy transition has significant implications for Europe:

- Imports from France: France, where 67% of electricity comes from nuclear power, supplies electricity to Germany during periods of renewable shortfalls. This creates a paradox—Germany opposes nuclear power domestically but relies on it through imports.

- Czech Republic and Switzerland: Germany also imports electricity from these nuclear-reliant countries, highlighting the interconnectedness of Europe’s energy systems.

Germany’s Energy Consumption Trends in 2023

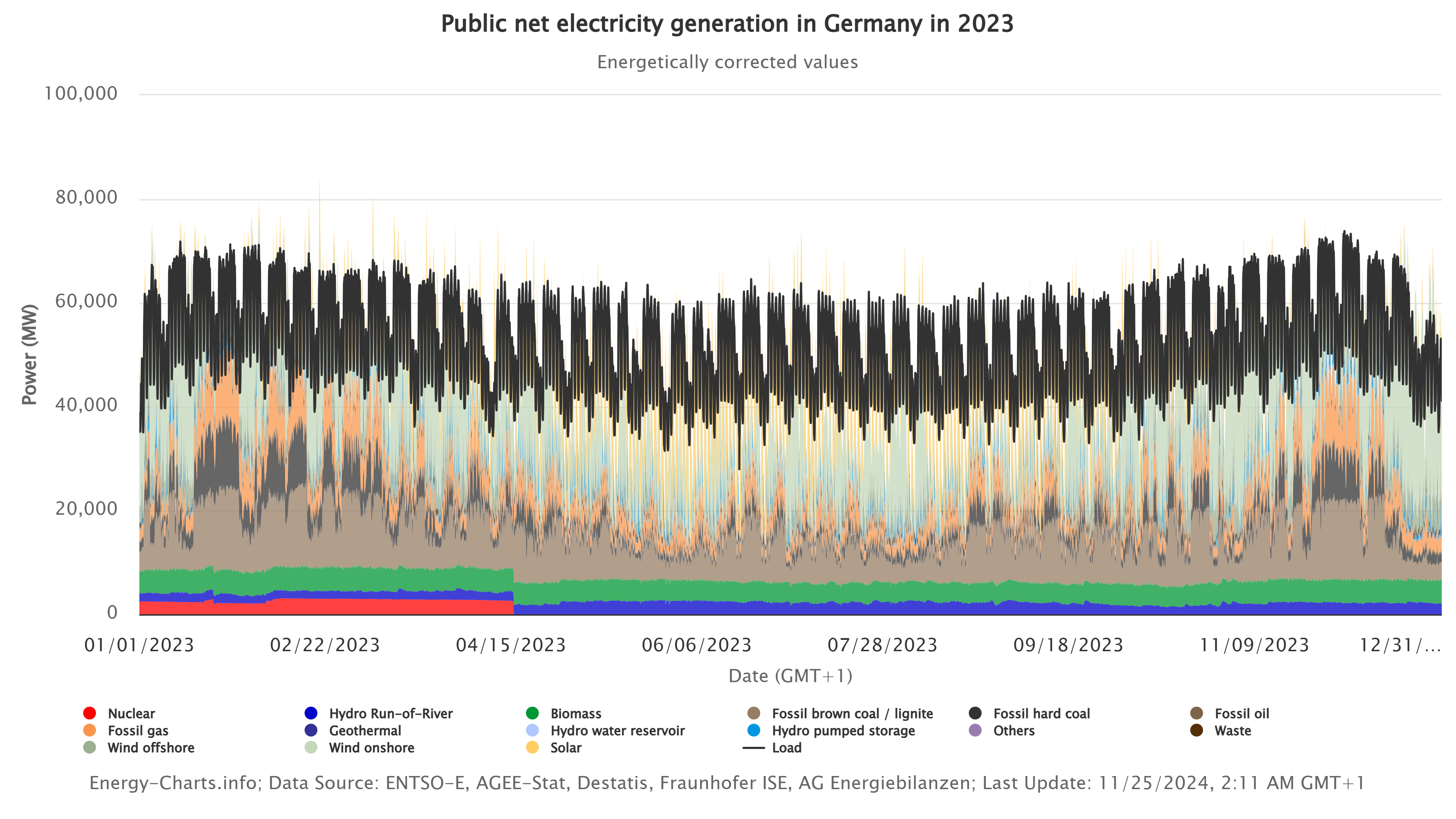

Germany’s energy mix in 2023 reflects its efforts to transition toward renewables while managing energy security challenges. The chart below illustrates public net electricity generation in Germany for the year:

Key Insights from the Chart:

- Renewables Lead the Way

- Wind (onshore and offshore) and solar energy account for a substantial share of electricity generation, particularly during summer (solar) and winter (wind). Renewables contributed 44.6% of Germany’s total electricity consumption in 2023.

- The Role of Fossil Fuels

- Coal and natural gas remain vital, especially during periods of reduced renewable output. Fossil fuels still contribute 30% to total generation, highlighting Germany’s transitional reliance on conventional energy sources.

- Nuclear’s Decline

- The minimal contribution of nuclear energy (red) reflects Germany’s decision to complete its phase-out in April 2023.

- Load Demand Trends

- The black line representing energy demand peaks during winter months, driven by heating and industrial usage, while summer months show lower consumption patterns.

Challenges and Opportunities

Challenges:

- Energy Security: The energy crisis highlighted Germany’s vulnerability to geopolitical disruptions.

- Economic Costs: Rising energy prices strain households and industries, impacting competitiveness.

- Dependence on Imports: While renewables grow, Germany remains dependent on imports from nuclear-reliant countries like France and the Czech Republic.

Opportunities:

- Green Hydrogen Leadership: Germany’s investments in hydrogen energy place it at the forefront of emerging clean technologies.

- European Integration: Germany’s role as an energy hub fosters regional energy cooperation and strengthens the European grid.

- Technological Innovation: Advances in energy storage and grid infrastructure will enhance Germany’s ability to manage intermittent renewable sources.

Conclusion

Germany’s energy journey is emblematic of the challenges faced by nations striving for climate neutrality in an increasingly uncertain geopolitical landscape. The 2023 energy consumption chart reveals a mixed picture: renewables are growing, but fossil fuels and energy imports remain critical. Germany’s decisions to phase out coal and nuclear power reflect its sustainability commitments but also expose its vulnerabilities.

Balancing energy security, economic stability, and climate goals will define Germany’s success in the coming years. Its experience serves as a case study for other nations navigating the delicate path toward a cleaner, more secure energy future.